utah non food tax rate

The 2018 bill that passed in the House was revenue neutral because it raised the tax on non-food items from 470 percent to 492 percent. Utah has a 485 statewide sales tax rate but also has 127 local tax jurisdictions including cities towns counties and special districts that collect an average local sales tax of 211 on.

State And Local Sales Tax Rates Midyear 2014 Tax Foundation

272 rows Utah has state sales tax of 485 and allows local governments to collect a local option sales tax of up to 335.

. The state provides a guidance page with plenty of examples on what is and what is not considered prepared food in Utah. Utah non food tax rate Thursday June 16 2022 Edit. Date Range Tax Rate.

January 1 2018 December 31 2021. There are -862 days left until Tax Day on April 16th 2020. The Utah UT state sales tax rate is 47.

Utah has an income tax credit equal to 6 of the current federal personal exemption as an applicable standard deduction. Utah UT Sales Tax Rates by City W Utah UT Sales Tax Rates by City W The state sales tax rate in Utah is 4850. Depending on local jurisdictions the total tax rate can be as high as 87.

Its a proposal that has not found traction within the Republican-controlled Utah Legislature and its leadership which this year prefers an across-the-board 160 million. The Utah state sales tax rate is 595 and the average UT sales tax after local surtaxes is 668. Utah has a single tax rate for all income levels as follows.

Reduced from 1591 million to. 93 rows The Combined Sales and Use Tax Rates chart shows taxes due on all transactions. For example a bagel sold without utensils is.

Counties and cities can charge an additional local sales tax of up to 24 for a maximum. Tax rates are also available online at Utah Sales Use Tax Rates or you can contact the Tax Commission at 801. With local taxes the total sales tax rate is between.

What is the non food tax in Utah. January 1 2022 current. There are a total of 127 local tax jurisdictions across the state.

Congress Should Reduce Not Expand Tax Breaks For Capital Gains Itep

What Is The Combined State And Local Sales Tax Rate In Each Us State Answers

How To Charge Your Customers The Correct Sales Tax Rates

Center For State Tax Policy Tax Foundation

How To Charge Your Customers The Correct Sales Tax Rates

Utah Sales Tax Small Business Guide Truic

States Without Sales Tax Article

2022 Sales Tax Rates State Local Sales Tax By State Tax Foundation

Tax Burden By State 2022 State And Local Taxes Tax Foundation

Sales Tax On Grocery Items Taxjar

Calculate Sales Tax On Car Deals 53 Off Www Ingeniovirtual Com

How Do State And Local Sales Taxes Work Tax Policy Center

Virtually Every State Tax System Is Fundamentally Unfair Taking A Much Greater Share Of Income From Low And Middle Income Familie Higher Income State Tax Tax

States Without Sales Tax Article

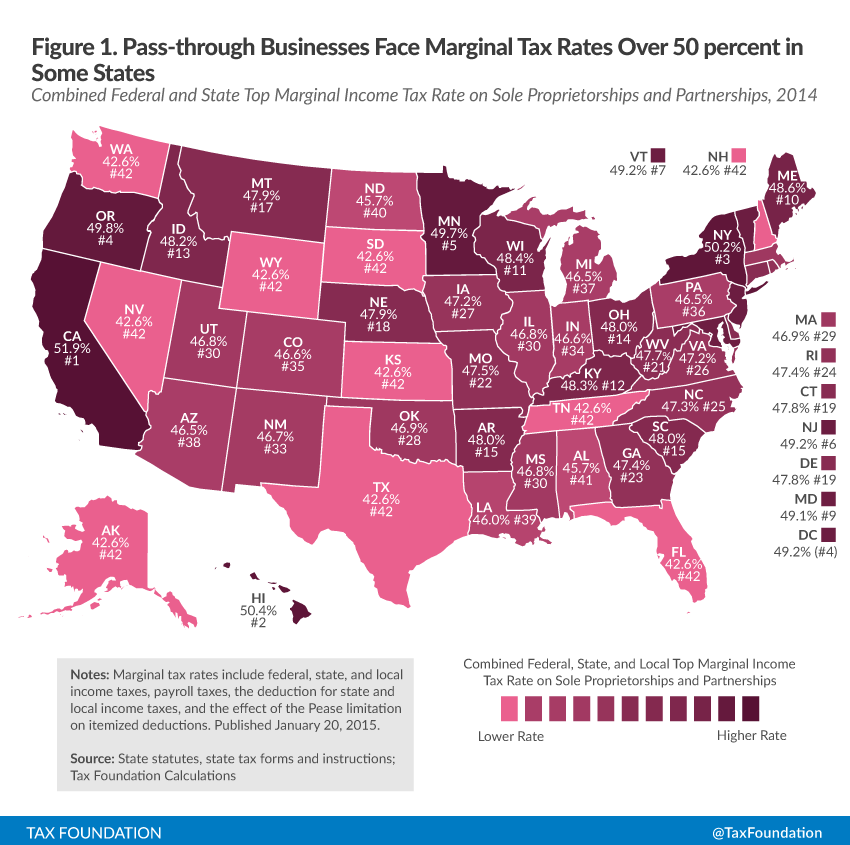

An Overview Of Pass Through Businesses In The United States Tax Foundation